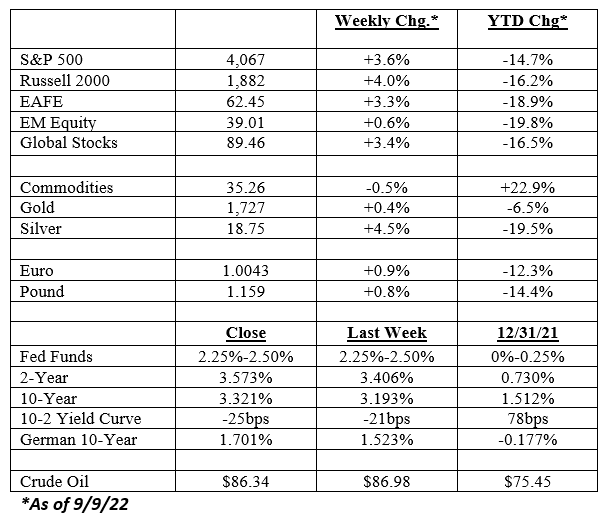

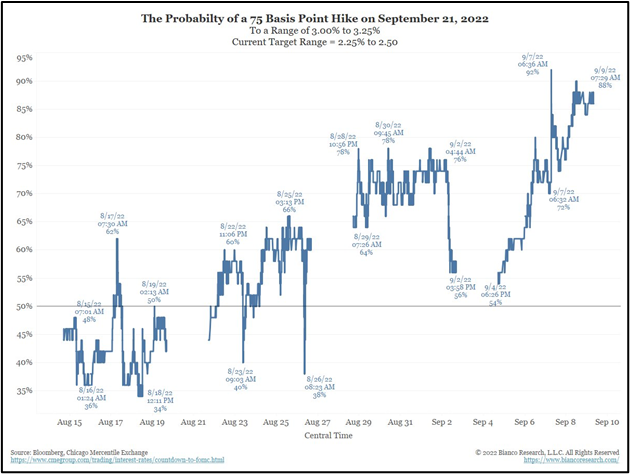

The markets spent the week trying to find a narrative to believe. On the one hand, every Fed speech this week focused on the need for another 75bps hike in the funds rate in a couple weeks. I won’t go through the list of speakers, but the message was uniform. The market heard them loud and clear – the probability of a 75bps hike is now close to 90%, up from a coin flip back in mid-August.

When bonds and stocks chose to think about this, they swooned a little.

But then they moved on and focused on the other growing narrative – that we might have seen the worst of inflation. Next Tuesday the closely watched Consumer Price Index for August is released. The consensus estimate is for a slight fall, as you can see below.

Falling inflation – can that be right?

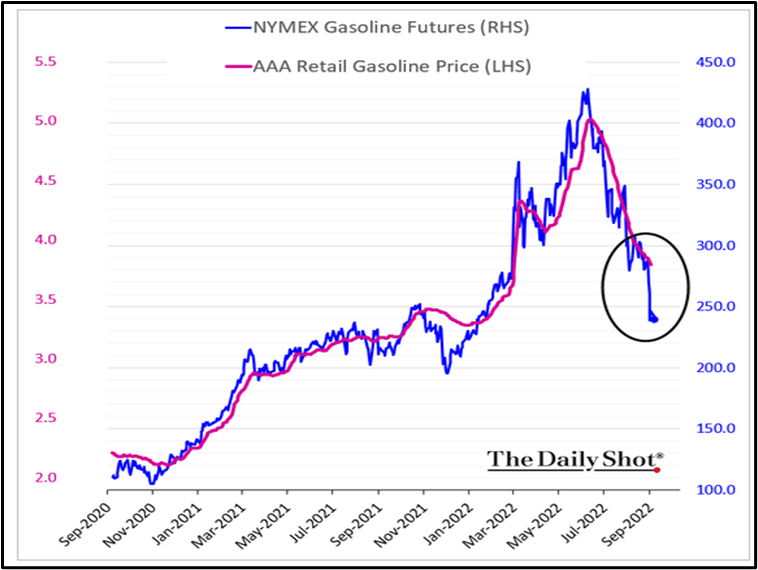

It is sure possible that the headline inflation number, that includes energy, could have fallen last month. After all, oil prices are down roughly -17% from the end of July, and gasoline prices have come off the boil.

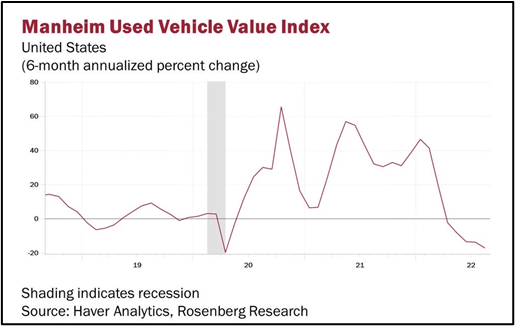

There are other factors at play as well. Used car prices were a meaningful player in the inflation upswing, and they seem to have cracked.

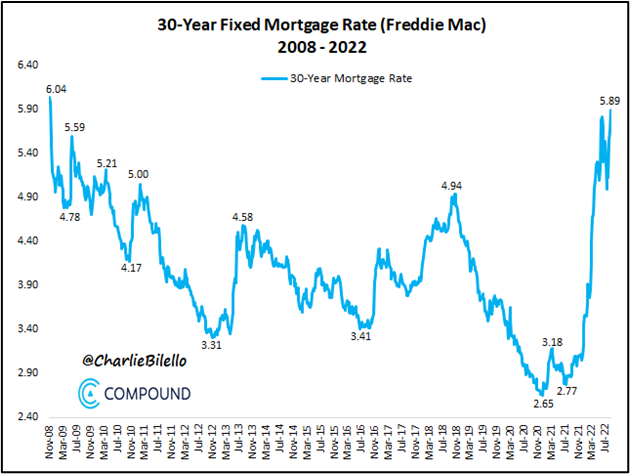

And then there is housing. While home prices aren’t in the inflation calculation, there is some thought rental prices (that are in the calculation) might start to reflect the weakness in the housing market. After all, interest rates are weighing on housing activity with the 30-year mortgage rate hitting new highs.

Prices are now falling nationwide, at least on a month-over-month basis.

Finally, the market’s expectation of where inflation will be twelve months from now has plummeted. Back in June the expectation was for 6% inflation next year. Now it’s just 2.5%.

The market could sure be wrong on this – it has been before – but how the Fed reacts to moderating inflation will a big driver of asset prices into year-end.

Charts We Found Interesting

1 – Soaring energy costs are triggering massive bailouts from both the U.K. and German governments.

2 – Thankfully, Europe is unlikely to run out of natural gas this winter. Storage levels have been topped up and demand is down significantly.

3 – This is going to take time, but Europe will find another source of gas. LNG terminals are sprouting up all over the place.

4 – Much of the gas will come from the U.S., but it turns out that in northern England there is about a thousand trillion cubic feet of natural gas. With modern technology maybe 10% of this is extractable. What’s that worth??

5 – The Fed has over 20K employees and spends roughly $2.6bn a year on salaries.

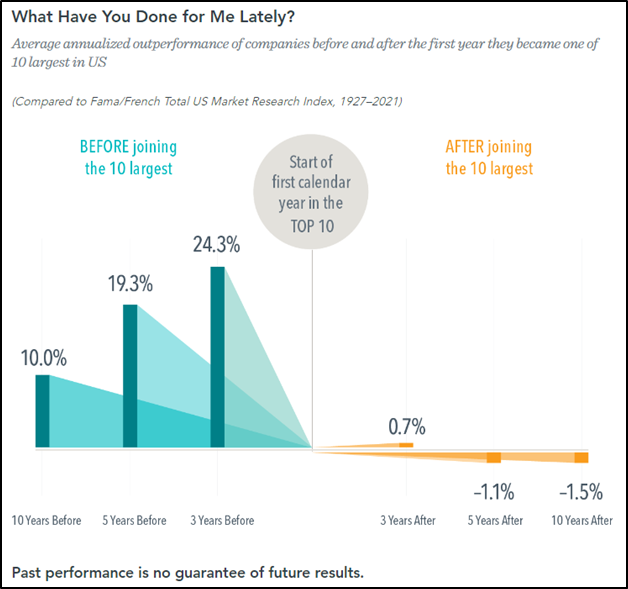

6 – Buying yesteryear’s winners is not a winning strategy.

7 – A 1952 mint condition Mickey Mantle baseball card sold for $12.6 million last week, a record price for a piece of sports memorabilia. The Mickey Mantle card was sold by waste management businessman Anthony Giordano, who acquired the card for $50,000 in 1991. That works out to roughly a 20% annualized return – not bad!!

8 – Not all heroes wear capes – A Nebraska man paddled 38 miles down the Missouri River in an 846-pound pumpkin (that has a cup holder carved in it).

Have a good weekend.