It was all about inflation this week. Tuesday’s CPI report was basically more of the same, but the reaction to it was…maybe pronounced is the word? Out of proportion? I’m not so sure about that. Violent? Almost certainly.

It was all about inflation this week. Tuesday’s CPI report was basically more of the same, but the reaction to it was…maybe pronounced is the word? Out of proportion? I’m not so sure about that. Violent? Almost certainly.

Now it’s not like the reported numbers were massively above expectations. The year-over-year change for August came in at +8.3% – expectations were for +8.1%. The month-over-month change was +0.1% versus expectations of -0.1%. What’s a couple tenths between friends??

Well, what drove the markets into a tizzy were a couple related stats. First, core inflation for the month came in almost double expectations – +0.6% versus an expected +0.3%.

Secondly, there’s a growing realization that inflation in the services sector is percolating. The chart below shows the year-over-year change in the four main components in the inflation report – services, goods, food, and energy. It’s clear that the blue bars are steadily marching higher.

To quote The Economist:

‘It is tempting to sift through the components of the inflation basket in an endeavour to find signs of cooling. At one point inflation was driven by stratospheric prices for second-hand cars and gummed-up supply chains, as locked-down Americans splurged on goods. These pressures have since eased. The increases today reflect a surge in the prices of some services, such as housing, which could eventually slow down, too.

Yet when underlying inflation has been this high for this long the simplest explanation is the most obvious, no matter what happens to individual components: the economy is still overheating. The effects of generous fiscal stimulus, which stoked demand during the pandemic, linger today.’

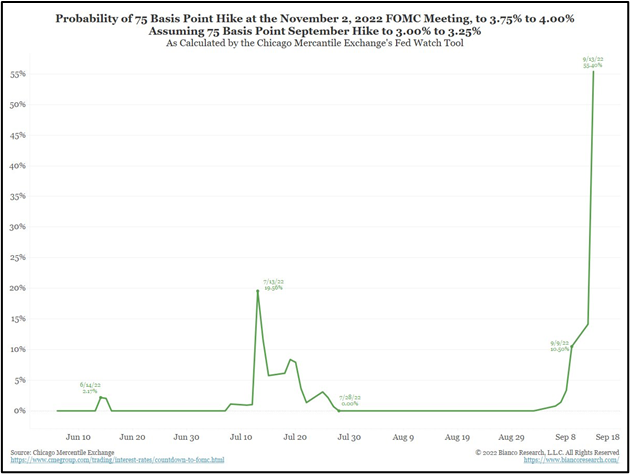

The implication is that rate hikes will continue until inflation comes off the boil. A 75bps hike next Wednesday is basically a sure thing, and as you can see below, the odds of another 75bps hike at the November meeting are now well over 50%.

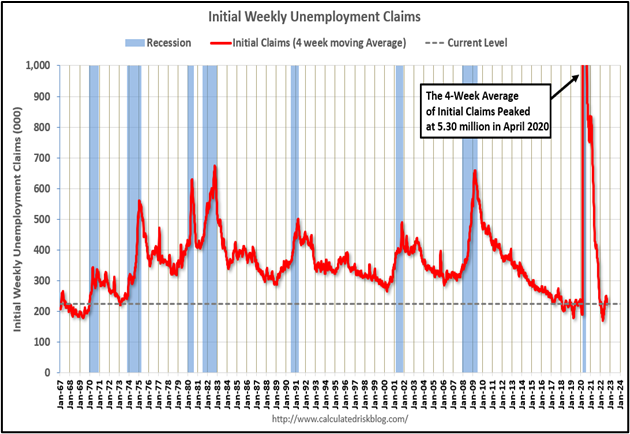

What gives those analysts looking for another large hike in November some confidence is the fact that the U.S. labor market seems to remain fine. For example, weekly unemployment claims fell again this week to 213K. If we were on the cusp of a recession, you’d expect numbers of 400K or more week after week. So far that isn’t happening.

But there are clear signs the global economy is soft. FedEx reported earnings Thursday afternoon and you might say they missed expectations. Earnings of $3.44 versus $5.10 expected. The stock lost more than a fifth of its value on Friday.

FedEx is thought of as a bellwether as their global shipping network touches everything. Volumes were down in Europe and China as you’d expect. But there are also company specific problems. It’s also notable that their main rival, UPS, reaffirmed their earnings guidance two months ago. But how stale is that data point? The next earnings reporting season that starts in October is going to have a lot of crosscurrents.

Charts We Found Interesting

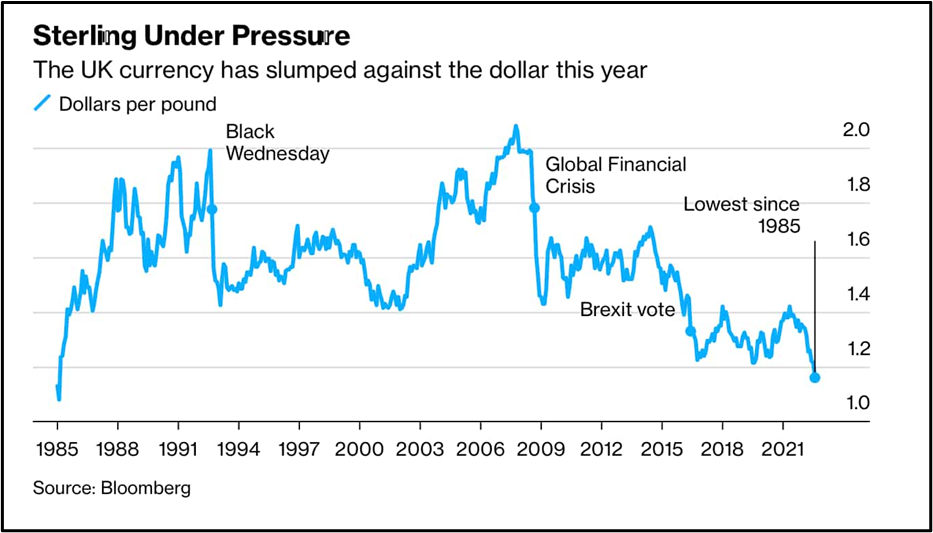

1 – Thirty years ago today the U.K. pound was crushed after the currency dropped out of the European exchange rate mechanism – a system designed to reduce currency fluctuations ahead of the launch of the euro (George Soros also made the legendary billion dollars on this trade). Well, thirty years later the currency still can’t get out of its own way!!

2 – The average rate on a 30-year fixed mortgage climbed to 6.02% this week, up from 5.89% last week and 2.86% a year ago, according to a survey of lenders released Thursday by mortgage giant Freddie Mac.

3 – I had to read the headline twice to make sure it said what I thought it did. The Argentinian central bank hiked rates by 5.5% this week to…….75%.

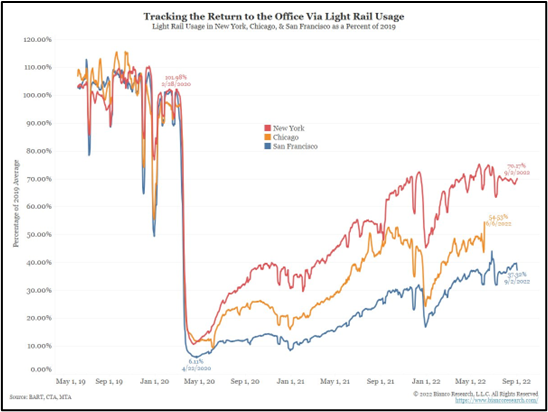

4 – People in the Bay Area aren’t too excited about getting back on Bart.

5 – Europe’s energy shock in perspective.

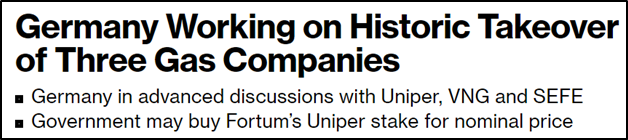

6 – Germany is being forced to nationalize three of the country’s largest natural gas companies.

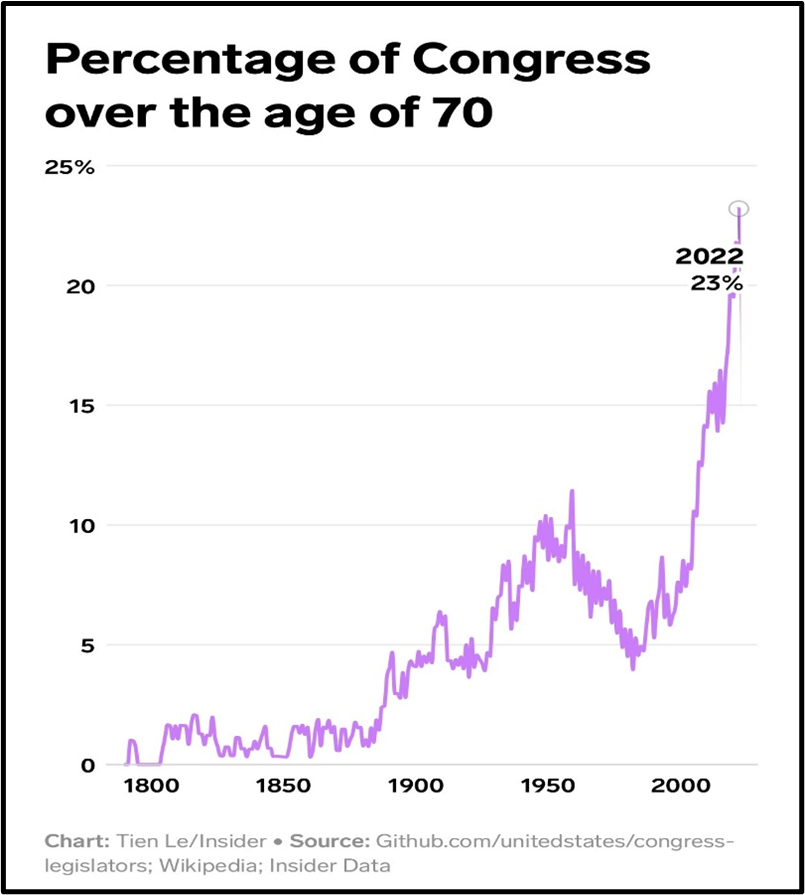

7 – In a bull market since 1999.

Have a good weekend.

Published by Gemmer Asset Management LLC The material presented (including all charts, graphs and statistics) is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The material is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objective, financial situations, or needs of individual clients. Clients should consider whether any advice or recommendation in this material is suitable for their particular circumstances and, if appropriate, see professional advice, including tax advice. The price and value of investments referred to in this material and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or prices of, or income derive from, certain investments. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Gemmer Asset Management LLC (GAM). Any mutual fund performance presented in this material are used to illustrate opportunities within a diversified portfolio and do not represent the only mutual funds used in actual client portfolios. Any allocation models or statistics in this material are subject to change. GAM may change the funds utilized and/or the percentage weightings due to various circumstances. Please contact GAM, your advisor or financial representative for current inflation on allocation, account minimums and fees. Any major market indexes that are presented are unmanaged indexes or index-based mutual funds commonly used to measure the performance of the US and global stock/bond markets. These indexes have not necessarily been selected to represent an appropriate benchmark for the investment or model portfolio performance, but rather is disclosed to allow for comparison to that of well known, widely recognized indexes. The volatility of all indexes may be materially different from that of client portfolios. This material is presented for informational purposes. We maintain a list of all recommendations made in our allocation models for at least the previous 12 months. If you would like a complete listing of previous and current recommendations, please contact our office.